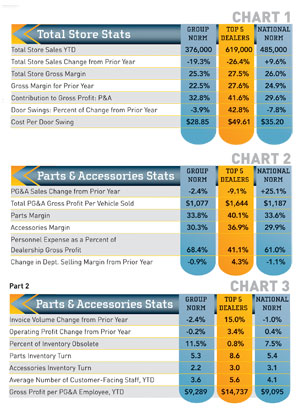

This month, we’ll review January parts and accessories department data, which includes apparel. We’ll compare a good-performing metric 20-group with the National Norm (NN) numbers and the averages for the Top 5 dealers for this group in each category.

This month, we’ll review January parts and accessories department data, which includes apparel. We’ll compare a good-performing metric 20-group with the National Norm (NN) numbers and the averages for the Top 5 dealers for this group in each category.

As you can see, sales this January weren’t as strong as last year for the group or the Top 5 dealers. It is likely that the Top 5 dealers’ revenue reduction heavily influenced the group numbers. Although some of this may be weather-related, the 20-group members are from all parts of the country. In comparison, the overall National Norms were up almost 10 percent. Although sales may have declined, total store gross margins increased for most dealers compared with last year. The Top 5 remained at an excellent 27.5 percent. These are very strong numbers for our industry.

The P&A contribution to total store gross profit was up considerably for the group and the Top 5 — this might indicate a reduction in their unit sales as a contributor. That would certainly be consistent with the loss of store total sales.

Nationally, PG&A sales increased nicely. Here is yet another indication of soft January unit sales: PG&A dollars per vehicle sold increased considerably. As unit sales decrease, the dollars sold per unit tend to increase.

Interestingly, when I looked at data from fall of 2012, the Top 5 dealer margins for both parts and accessories changed very little. They are very good at locking them in and holding them. The group and National Norm margins dropped slightly.

Personnel expense as a percent of dealership gross profit is high. This is due to these dealers ramping up their staff for the season — on top of sales being slow. Normal for this category would be around 35 percent.

Hmm. It is interesting that the Top 5 dealers managed to increase invoice volume. Since sales dollars dropped, I would have to say that folks bought more low-cost items from these dealers. Inventory obsolescence numbers are good — they should be at this time as most dealers should have written down their excess inventory to take the tax break. No more than 15 percent of your inventory should show up on a report of “no sale for 12 months.”

Parts turns are very strong. As I have stated before, you have to be careful not to get too high a number. There is a point of diminishing returns if you have to order too often because you don’t stock sufficient high-turn inventory to meet the needs of your service department, let alone your customers. The low turns in accessories is impacted by clothing. Historically, these items don’t turn as well as we’d like.

Wow. Check out the gross profit per employee for the Top 5 dealers. This is what can happen when you either hire the best people or provide the training to get your “B” players up to this level. I’m sure we would all like to see an extra $5,000 per employee in any given month. This number is a good one to use for comparison.

Have questions? Feel free to contact me for information, explanation or to discuss how GSA can help you grow your business profitably.

Steve Jones, GSA senior projects manager, outlines dealerships’ best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. Access to the new Voyager 5 data reporting and analysis system is available to any dealership for nominal fee. For more information on GSA’s management workshops, data reporting system, dealer 20-groups, on-site consulting or training, send Steve an email at [email protected] or visit www.gartsutton.com.