At GSA we track benchmarks through our involvement with dealer groups, such as the Best Operators Club. Some of the members have kindly consented to let us share their numbers from our real-time, web-based data reporting system.

Last month we shared some impressive numbers from a small dealership. This month we move to a much larger dealership to discuss profitability in the P&A department. This department is currently a significant area of focus for many dealers. As unit sales decrease, it is increasingly important to maximize your return from P&A.

This dealer is located in a western city with a population of 600,000 and a market area of more than a million. They retailed around 3,200 new and pre-owned units last year. Through September of ’08, they maintained a reasonable 16 percent margin on new units and an excellent 24 percent on pre-owned. For 2008, they made a concentrated effort to improve profitability in the P&A departments. They employ one parts manager, 17 sales agents and three support staff.

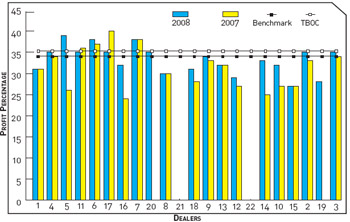

Our example dealer is number 5. Check out the 10 percent increase in accessories margin for September YTD! Through September of 2007 they were at 29 percent. For 2008 they were at 39 percent. In parts, they have come from 34 percent to over 38 percent — a respectable 4 percent improvement. Since this dealership sold over $3 million in accessories and $2.3 million in parts (YTD September 2008), every percent increase represents a sizable amount of dollars.

Chart 1 – September 2008

CY: current year

PVS: per vehicle sold

TBOC: average of the top five BOC members in this category

* Some rows and columns without data have been removed to reduce table sizes.

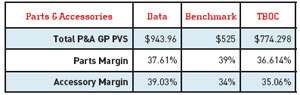

In Chart 2 you can see they make a serious effort to sell P&A with every unit. While the TBOC is averaging $774 PVS, this dealer is pumping out $944 per unit! Parts margin for September is down slightly from the YTD, but accessories are right on the number.

Chart 2

I asked the GM what they had done to achieve such an increase in profit margins for P&A. Did they change their process for counter sales? Did they install or improve a customer path process? What?

The answer was really pretty basic. He explained that the first thing they looked at was removing or reducing discounts. Any non-coded discount at the counter now requires an approval by the parts manager. Discounts to wholesales accounts (such as out of area repair facilities) were revised from cost plus 10 or 15 percent to cost plus 20 or 25 percent. They also reviewed and modified the parts price escalators in their point-of-sale software. “Don’t believe that you can’t charge what you need to make,” encourages the GM. “If you provide good service, they don’t question the price.”

The GM also said that a big improvement in profitability came from paying more attention to purchasing P&A. They re-focused on learning and using the OE and aftermarket suppliers’ programs and taking advantage of special buys. This is no small task for a dealership that carries all the major brands and stocks accessories from multiple aftermarket suppliers.

Paying attention to details in your P&A department can help you increase sales and profits. It may mean the difference between making good money and having to lay off a key staffer. Provide exceptional service, eliminate or reduce discounting, charge the prices necessary to achieve the margins you need, and use your suppliers’ programs to buy right.

Turn 14 Distribution Adds Gaerne to the Line Card

Gaerne is an Italian motorcycle footwear brand.

Turn 14 Distribution has announced the addition of Gaerne, a motorcycle footwear company, to its extensive line card.

“We are thrilled to welcome Gaerne to our product lineup. The company’s reputation for producing top-tier motorcycle footwear aligns with our mission to provide our customers with the best products the industry has to offer. Gaerne’s dedication to innovation, quality and performance makes them a perfect fit for our portfolio,” said James Kramer, divisional purchasing manager, Turn 14 Distribution.

Royal Enfield Introduces Global Rentals and Tours

The rental program extends to 60-plus destinations.

Segway Powersports and Octane Shift Gears With Strategic Financing Partnership

Effective, April 1, 2024, prime and non-prime consumers are eligible for financing on Segway’s entire range.

2024 Harley-Davidson Homecoming Festival Kicks Off in 100 Days

Tickets are on sale for Veterans Park headliners Red Hot Chili Peppers, Jelly Roll and HARDY.

Industry Veterans Marilyn Stemp and Steve Piehl Appointed to Sturgis Motorcycle Museum and Hall of Fame’s Board

Stemp and Piehl will begin serving on the board immediately.

Other Posts

MIC Statistical Annual Now Available

Get ahead of the motorcycle sales season.

REV’IT! TAILORTECH Design Challenge Offers U.S. Riders Chance to Win Custom Race Suit

Submissions will be accepted through April 21, 2024.

Vespa World Days 2024 Set to Run April 18-21

The National Vespa Clubs from 55 countries come together, uniting thousands of Vespas from five continents.

Mips Becomes Official Safety Partner of the FIM Motocross World Championship

This exclusive collaboration promotes enhanced safety awareness across the MXGP series.