Last month we explored the TBOC 2009 year-end numbers. This month we’ll look at how February 2010 compares with February 2009. I have shown the TBOC numbers for both years, as well as the comparable National Norms (NN) from our other groups. In some cases, the different reporting systems used by these 20-groups are not totally comparable. In those instances, I have entered "N/A."

Are things getting better? If some recent 20-group member e-mails are any indication, yes, they are improving for many dealers. This should be reflected in the coming month’s data comparisons.

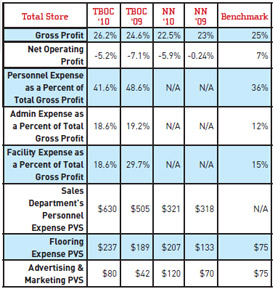

There are some improvements in the Total Store (Chart 1), particularly in the TBOC groups. However, these groups are still showing much higher personnel expenses than the National Norms groups. Conversely, the National Norms groups spent a lot more per unit to reduce inventory.

Chart 1

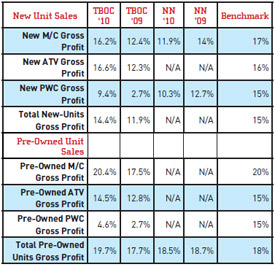

Chart 2 shows new and pre-owned unit margins improving significantly for TBOC members. Overall, pre-owned margins are very strong. I keep saying this is an area of opportunity for many dealers, and for good reason.

Chart 2

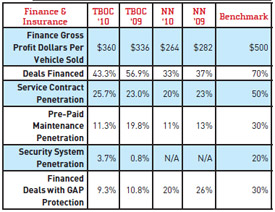

Although F&I numbers in Chart 3 are not what they were a few years ago, this is still an important profit center for our business. Note that finance penetration is still the issue. You need to approach your local credit unions if you haven’t already. They have money and are very aggressive in many markets. If they aren’t interested today, keep going back, as things change rapidly. Put together a good lender packet. You need to sell them on your business.

Chart 3

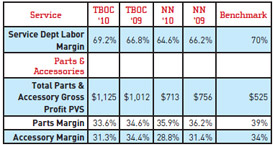

In Chart 4 you can see dealers are focused on improving their service margins. This needs to be run as a very tight ship in order to be profitable. P&A margins are slipping a bit. Some dealers are becoming more competitive with Internet prices, as they can’t afford to let people walk. Many dealers are using specially priced accessories and/or clothing packages as incentives for closing unit sales.

Chart 4

As I said last month, track your numbers, keep inventory and overhead under control, hire the right people and provide exceptional customer service. These are still the keys to success.

At GSA we track benchmarks through our involvement with dealer 20-groups. The TBOC data comes from the groups that are in the a real-time, web-based data reporting system. National Norms are compiled from the groups that report in the former-RPM data system.

Maximize Every Sale With F&I and PG&A

This recorded AIMExpo education track discusses how the bike is just the start of the sale.

At AIMExpo 2024, Greg Jones, content director for MPN, moderated the finance and insurance (F&I) panel in MPN's Dealer Excellence education track. The panel consisted of Jason Duncan, McGraw Powersports; JD Baker, Protective Asset Protection; John McFarland, Lightspeed; and Zachary Materne, Apiar Commercial Risk Management.

In this session, Jones and the panel discuss how to maximize every sale beyond the bike with F&I and parts, gear and accessories (PG&A). The panel advises on best practices, how to make the purchase process more exciting, how to utilize technology in this process and more.

Elevating Your Sales Game Through Parts Packaging

Breaking down the art and science of a well-designed, customer-focused, profit-friendly parts package.

Unleash Your Experts: How to Be a Long-Tail Resource for Powersports Enthusiasts

Closing deals and providing service are a dealer’s bread and butter, but your dealership has far more to offer.

Building a Growth Stategy With a Powersports Playbook

Success isn’t a fluke, and it’s not luck. It’s a strategy.

Fostering an F&I Culture That Sells

Dealership success hinges on the ability to cultivate a strong F&I culture.

Other Posts

Increasing Profits Through Accessorizing

Go out and find the units to dress up — there’s lots of extra profit to be made.

AJ Meisel Creates Community at Plano Kawasaki Suzuki

AJ has learned a thing or two over her 30-year powersports career.

Q&A: Powersports Consumer Sentiment Forecast for 2024

Consumers aren’t delaying purchases because of the economy, but they’re still looking for deals.

Nothing But Good Vibes at Santa Barbara Motorsports

Santa Barbara Motorsports is working to make every door swing count.