At GSA we track benchmarks through our involvement with dealer groups such as the Best Operators Club. Some of the members have kindly consented to let us share their numbers from our real-time, web-based data reporting system.

In this column we’re going to review the July F&I numbers for one of our member dealers and the related TBOC averages. In 2007, this dealer sold 800 motorcycles, ATV and UTV units, plus 140 trailers and 39 boats. The dealership is located in a town of 22,000 on the outskirts of a city of 180,000 people.

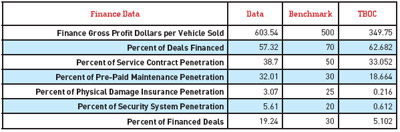

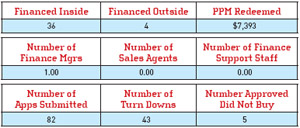

In Chart 1 we see that they have only one F&I person. For July, they captured 90 percent of the financed deals. They had an approval rate of 52 percent. Tracking and following up on “approved but did not buy” deals is also very important. Did they buy elsewhere? Why? What could you have done to get these deals?

Chart 1

CY: current year

PVS: per vehicle sold

TBOC: average of the top five BOC members in this category

* Some rows and columns without data have been removed to reduce table sizes.

In Chart 2 you can see that their overall July finance penetration was just under 60 percent. This is short of the benchmark of 70 percent, but not bad. If you don’t get the financing, it is very hard to maximize add-on sales of F&I and P&A products.

Last year at this time, this dealer was averaging just over $300 PVS in F&I GP. This year he has jumped to over $600 PVS! How did he accomplish this? According to the dealer, there were two main reasons: They hired a former auto F&I person who was tired of the long hours and pressure. The five-day week in this powersports dealership was just what he was looking for.(It should be noted that there are quite a few good people leaving the auto business — sales mangers and salespeople as well as F&I managers. This is a good time to take advantage of their current business situation.) They implemented a structured selling process with the correct turnover to the business (F&I) office. They also utilized a four-square worksheet process, and always asked for a down payment amount. This can often be converted to F&I products sales if customers are approved for little or no down payment.

Chart 2

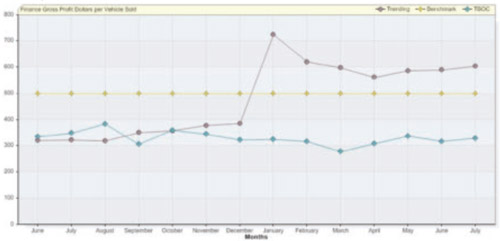

In the trend analysis in Chart 3, you can clearly see what happened when they hired the right person for the F&I position and implemented the correct processes. In a very short time they were able to nearly double their F&I income.

“If you do not enforce the sales process, the four-square and the consistent turnover to F&I, it is very difficult to achieve big numbers in the business office,” notes the dealer. Obviously, having a fully trained and experienced F&I person is also crucial to maximizing your F&I potential. In today’s highly-competitive market, it is essential to have an effective F&I department to pick up the margins. Remember, F&I stands for “found income.”

Chart 3

Elevating Your Sales Game Through Parts Packaging

Breaking down the art and science of a well-designed, customer-focused, profit-friendly parts package.

Good parts managers are a rare breed. We are among the few who enjoy flipping through paper catalogs and covering them with notes. We love seeing how other companies merchandise shelves. We are always absorbing different sales techniques and wondering if we could use them too.

In that vein, when it comes to continuing to boost our numbers post-COVID, I have a few strategies for you to try. It might sound odd, but not everyone can remember that most winches need a winch mount. Or that certain winches require a hidden harness stored at the bottom of a book (hello, Can-Am). Or that Honda has split its winch harness between the winch and the mount. If you don't want service techs to hate you, you need to order both part numbers or else face their wrath.

Unleash Your Experts: How to Be a Long-Tail Resource for Powersports Enthusiasts

Closing deals and providing service are a dealer’s bread and butter, but your dealership has far more to offer.

Building a Growth Stategy With a Powersports Playbook

Success isn’t a fluke, and it’s not luck. It’s a strategy.

Fostering an F&I Culture That Sells

Dealership success hinges on the ability to cultivate a strong F&I culture.

Increasing Profits Through Accessorizing

Go out and find the units to dress up — there’s lots of extra profit to be made.

Other Posts

Segway Powersports and Octane Shift Gears With Strategic Financing Partnership

Effective, April 1, 2024, prime and non-prime consumers are eligible for financing on Segway’s entire range.

Octane Redefines Powersports Lending With Dealer Portal 2.0

Dealer partners can deliver an even faster, easier financing experience for their customers.

Synchrony Partners With BRP to Provide Retail Financing Options in the U.S.

Synchrony to offer consumers flexible financing on powersports products.

Cycle Trader and ATV Trader Expand Buy Now, Digitizing All Finance and Purchase Steps

The expanded Buy Now platform fast-tracks financing and sales for both dealers and buyers.