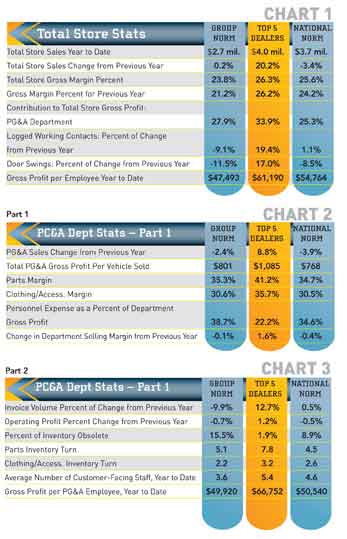

I know it sounds like a broken record, but the best keep getting better. The Top 5 keep growing sales year-over-year. They are also holding a strong 26 percent gross profit margin for the overall store. It is good to see that margins have increased for the group and the National Norm as well.

I know it sounds like a broken record, but the best keep getting better. The Top 5 keep growing sales year-over-year. They are also holding a strong 26 percent gross profit margin for the overall store. It is good to see that margins have increased for the group and the National Norm as well.

The parts, garments and accessories (PG&A) department is a very important part of your overall business. As you can see, it provides between a 1/4 and 1/3 of the overall store gross profit. Having well-trained staff with the proper attitude and aptitude for their positions in this department is critical to maximizing your return on investment. Do a little analysis of your own operation. Has your parts manager been through parts management training? Is he or she implementing all the processes necessary for this department such as printing reports on slow-moving inventory and monitoring margins and turns by category? Is there an open-to-buy process for maintaining and controlling inventory levels? Is PG&A properly categorized in your computer so you can track sales by category effectively?

In part one of the department numbers, we see some reduction in volume for the group and the National Norm dealers. However, the Top 5 have increased sales as compared with last year. The number for PG&A per vehicle sold seems low, but keep in mind that it is relative to unit sales. As unit sales go up, the average PG&A per unit tends to decrease and vice versa.

Margins are something you should continuously monitor. They look good for the group and National Norm until you see how much better they are for the Top 5. Part of this is due to the Top 5 taking advantage of volume discounts and special purchase programs. Part of it is enforcing discounting policies. Part of it is minimizing slow moving inventory so you don’t have to discount it when it turns obsolete. By the way, these dealers do not discount parts to sales or service. Otherwise, they would be unable to be compared with the rest of the dealers. If you want to compare with these numbers, you will have to adopt the same policies.

As I have said in the past, personnel expense as a percent of department gross profit is an important tool to determine your staffing levels and compensation programs. Check out the huge difference in this number between the group and National Norm compared with the Top 5. Anytime you can get good volume with high margins and keep personnel expenses under 30 percent for this department, you are doing good. Twenty-two percent is phenomenal. Now, look at the gross profit per employee in part two. The right people with the right training are what allow them to have low personnel expenses as a percent of department gross profit.

Part two shows a good increase in invoice volume for the Top 5. Part of this is due to the effectiveness of the counter staff. However, I suspect these dealers also market and promote their PG&A departments.

The obsolete inventory numbers are always somewhat flakey as they may have large quantities of product that has been written off for tax purposes.

However, you should be targeting 15 percent or less as a realistic figure for PG&A that has not turned once in 12 months. Once it hits this point, get rid of it — send it back, discount and sell it, donate it, or write it off and dumpster it.

Are you hiring minimum-wage counter people, or do you have trained salespeople in those positions? Look at the numbers for gross profit per employee — how do you compare? This is where the rubber meets the road. Are they able to do the job? Do they need to be replaced? If they have the aptitude for the job and the proper attitude to do it well, consider providing ongoing training to keep them at their peak.

Steve Jones, GSA senior projects manager, outlines dealerships’ best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. Access to the new Voyager 5 data reporting and analysis system is available to any dealership for nominal fee. For more information on GSA’s management workshops, data

reporting system, dealer 20-groups, on-site consulting or training, send Steve an email at [email protected] or visit www.gart-sutton.com.