This month, we look at December’s data and how it compares with 2009 for this group.

This month, we look at December’s data and how it compares with 2009 for this group.

While the 23.5 percent total store gross profit margin in Chart 1 looks slightly anemic from the benchmark of 25 percent, the margin change from last year is 4.3 percent. This is huge! It is certainly another positive indicator. The 1.8 percent net operating profit caps the positive net trend for the year. However, the Top BOC (TBOC) dealers are higher yet at 2.9 percent.

Expenses have been held tight, and this is driving profitability up. If you can’t grow the revenue, you have to cut costs. In the end, profitability is all about expenses versus income.

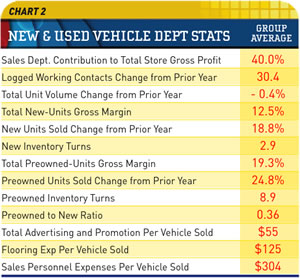

In Chart 2, we see a solid 40 percent contribution from sales to the overall store gross profit. The 30 percent increase in working contacts is mostly due to the dealers focusing on capturing customer information for proper follow-through. Prospecting is a significant factor in increasing sales during slow periods. The showroom log or CRM tool is a primary source for finding prospects.

New sales margins are a bit low, but better than they were last year. New and preowned unit sales were up significantly over December last year. Preowned not only has the big margins, check out the number of turns — almost nine turns a year is a big deal, especially when you are holding over 19 percent profits on those deals. Think about it — this is where the money is.

The $125 flooring expense per vehicle sold is high compared to the TBOC number of $104. In some of the groups, I have seen numbers in the $300 range. Sitting on slow movers too long will suck the profits out of your sales.

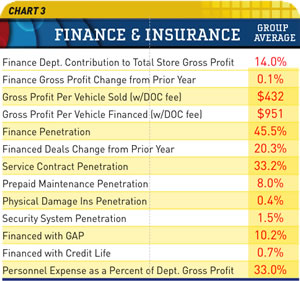

Focusing on Chart 3, for December, finance penetration dropped a bit to 46 percent. However, I know dealers who would give their left arm for this penetration number. You have to work at it. Finance sources seldom come to you these days. Check out the gross profit per vehicle sold and PVF. See the difference financing makes? Could you use an extra chunk of money like this on every sale? It is there for you if you make the effort to sell the products and have well-trained people with an aptitude for selling F&I.

Although the numbers are small, I predict that security systems will become a bigger and bigger deal as we recover. The factor that will influence the benefits to you is how much the OEs decide to include these on the units. Every time they “include” F&I products (such as extended service programs), they get in your wallet.

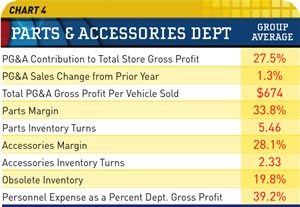

Chart 4 reveals small growth in P&A, but steady income has been a savior for many dealers throughout the worst part of this economy. Inventory turns are high at over five. This is because dealers reduced slow moving inventory and increased fast-movers. On the surface, this is a good thing. However, you can go too far and lose business because you never have what customers want in stock. Worse, you could be holding up repairs in your service department. This can be very costly in terms of customer satisfaction.

Accessories margin is low compared with the TBOC’s 30 percent. I have seen a number of dealers holding margins well above this number. Obsolescence is still high at almost 20 percent, but it is down from last month. This is probably due to member dealers “writing off” some of this dead inventory for tax purposes.

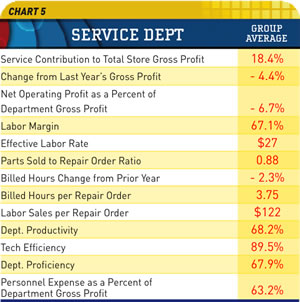

Service is the big opportunity area for most dealers. In Chart 5, we find that this group still has a long way to go to get service where is should be. In fact, it is worse than last year. Gross profit and net operating profit are both down as are the billed hours.

Labor margin is low — it needs to get to 70 percent. What also indicates problems here are the numbers for productivity, efficiency and proficiency. They should be over 85 percent, 100 percent and 85 percent, respectively. This can be a result of issues with proper billing or documentation of tech hours, or it could be management issues such as not providing a steady flow of work and/or not keeping on top of the techs to ensure they are on the job when they should be. Regardless, this should be addressed and soon. Every department should be able to make a profit and stand on its own.

Please use these numbers to compare with the performance of your dealership.

Note: Our Voyager 4 data reporting and analysis system is available for any dealership to use for a very nominal fee. For more information on our data reporting system, dealer 20-groups, on-site consulting or training, drop me an email at [email protected] or visit www.gartsutton.com.

At GSA we track current powersports dealer benchmarks through our involvement with our dealer 20-groups. The data comes from reports compiled from the dealers’ input into our real-time, web-based data reporting system.

Steve Jones, GSA senior projects manager, outlines dealership best business practices to boost margins, increase profitability and retain employees. His monthly column recaps critical measurements used by the leading 20-group dealers. GSA is recognized as the industry’s #1 authority on dealer profitability.