At GSA we track benchmarks through our involvement with dealer 20-groups. Some of the members have kindly consented to let us share their numbers. The TBOC data comes from our real-time, web-based data reporting system. The National Norms are compiled in our former-RPM data system. Altogether, these numbers represent the data collected from over 200 high-quality dealers.

The following article deals with October numbers and includes the TBOC data from one of the better-performing groups compared with the National Norms. I have also included the YTD National Norms data in some of these charts.

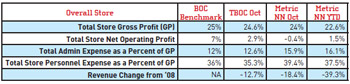

In Chart 1 you can see that dealers were still struggling to get to that 25% Total Store GP. However, it was good to see positive NOP for TBOC, small though it may be. The rate of revenue change was better in September than it has been in months. However, it fell back for some of the NN dealers in October. Still, I take these to be positive signs, and hope they will hold up in the coming months.

The NN dealers still need to work harder on getting personnel expenses in line. This is a tough area to tackle, but it represents a huge part of dealership expenses as a portion of GP. Not controlling personnel expenses has "killed" a lot of dealers in the last few months. It is vital to do whatever it takes to get it in line with industry standards.

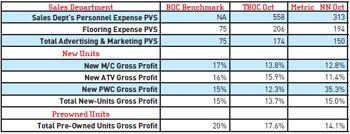

PVS/PUS = per vehicle sold

TBOC = average of top 5 BOC members (based on store GP)

NOP = Net Operating Profit

NN or N Norm = National Norms (data compiled from multiple groups).

Chart 1

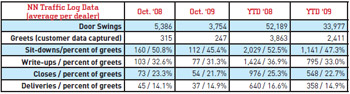

Now we’re going to look at a new area of the numbers. Instead of dollar data, it is customer data. Chart 2 shows the NN traffic and closing data. This chart points out the value of having door counters. They are generally inexpensive (starting around $100). The most frequent objection I hear is that they are never accurate because of the employees going in and out, etc. It doesn’t matter. It all averages out. Get door counters for your store and start tracking these numbers; verify the response to your advertising and promotions. Find out what your sales staff is doing with these people.

Chart 2

YTD door swings were down 35% compared with 2008. However, for October they were only down 30%. This is another small but positive economic indicator. Overall, the percentage of the customers greeted (as recorded on the traffic log) that sat down with a salesperson has not changed as much as I expected. Neither has the percent of write-ups or closes. Although the YTD numbers are down, there was an improvement in the percentage of deliveries for October compared with last year. Looking at the GP numbers, it is apparent that dealers are clearing all the inventory they can.

Chart 3

Chart 3 recaps some of the other key performance indicators for our business. Here you can see just how dramatically the sales department’s personnel expense impacts cost per unit sold.

This should be reinforce the fact that you need to be extremely adept at understanding the numbers and controlling your expenses, particularly, personnel expenses. Many dealers are putting in a lot more floor time in their dealerships in order to reduce staff. Others are utilizing part-time people to handle peak business periods. You have to have good data in order to address this in your dealership. The number of dealer failures is at an all-time high. Please don’t become one of them.

Maximize Every Sale With F&I and PG&A

This recorded AIMExpo education track discusses how the bike is just the start of the sale.

At AIMExpo 2024, Greg Jones, content director for MPN, moderated the finance and insurance (F&I) panel in MPN's Dealer Excellence education track. The panel consisted of Jason Duncan, McGraw Powersports; JD Baker, Protective Asset Protection; John McFarland, Lightspeed; and Zachary Materne, Apiar Commercial Risk Management.

In this session, Jones and the panel discuss how to maximize every sale beyond the bike with F&I and parts, gear and accessories (PG&A). The panel advises on best practices, how to make the purchase process more exciting, how to utilize technology in this process and more.

Elevating Your Sales Game Through Parts Packaging

Breaking down the art and science of a well-designed, customer-focused, profit-friendly parts package.

Unleash Your Experts: How to Be a Long-Tail Resource for Powersports Enthusiasts

Closing deals and providing service are a dealer’s bread and butter, but your dealership has far more to offer.

Building a Growth Stategy With a Powersports Playbook

Success isn’t a fluke, and it’s not luck. It’s a strategy.

Fostering an F&I Culture That Sells

Dealership success hinges on the ability to cultivate a strong F&I culture.

Other Posts

Increasing Profits Through Accessorizing

Go out and find the units to dress up — there’s lots of extra profit to be made.

AJ Meisel Creates Community at Plano Kawasaki Suzuki

AJ has learned a thing or two over her 30-year powersports career.

Q&A: Powersports Consumer Sentiment Forecast for 2024

Consumers aren’t delaying purchases because of the economy, but they’re still looking for deals.

Nothing But Good Vibes at Santa Barbara Motorsports

Santa Barbara Motorsports is working to make every door swing count.