The following article compares a representative sample of November 2009 versus 2008 Top of the BOC (TBOC) data.

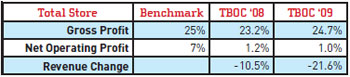

In Chart 1, we see total store gross profit was up, but net was slightly down. The good news is that there was a net for November. This was a very tough month for most dealers, as evident by the revenue change from last year.

PVS/PUS = per vehicle sold

TBOC = average of top 5 BOC members (based on store GP)

NOP = Net Operating Profit

NN or N Norm = National Norms (data compiled from multiple groups).

Chart 1

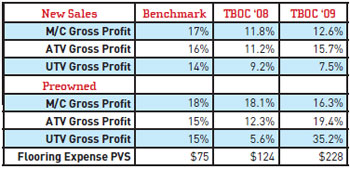

Chart 2 shows that most unit categories were up, preowned UTV in particular. Dealers are working harder to maintain margins in spite of inventory dumping. Regrettably, flooring PVS was also up. Most OEs are working to help this situation by reducing build plans, order quantities and even doing some inventory balancing in the field.

Chart 2

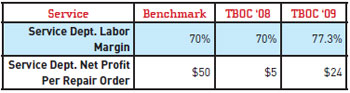

In Chart 3, service labor margin has really come up. Service sales have improved for many dealers and the remaining techs are working harder. This effectively reduces the cost of goods sold (tech compensation) relative to revenue. There has also been a significant improvement in net profit per repair order.

Chart 3

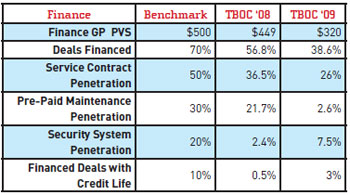

Chart 4 reveals that F&I has taken a major hit during this recession. Two years ago dealers were "killing" the $500 benchmark. Now they are at $320 gross profit. The national norms are showing $370 year to date, a bit better, but not much. The main culprit is the decrease in finance penetration. Plus, financed deals have little extra room for add-on stuff. PPM decreased as dealers backed off due to high redemptions. Many dealers spent their reserves to stay alive while customers started using their PPM more. Take note of this. You must retain close to 80% of current potential PPM redemptions. Security systems look to be a growing product category. There are a lot of good products and consumers are buying them. Also, credit life has found new life (sorry).

Chart 4

Use this information to see what you can improve in your dealership operation. Get a handle on every aspect of your business. Measure, monitor and manage it so you will be around when this thing finally runs its course.

Elevating Your Sales Game Through Parts Packaging

Breaking down the art and science of a well-designed, customer-focused, profit-friendly parts package.

Good parts managers are a rare breed. We are among the few who enjoy flipping through paper catalogs and covering them with notes. We love seeing how other companies merchandise shelves. We are always absorbing different sales techniques and wondering if we could use them too.

In that vein, when it comes to continuing to boost our numbers post-COVID, I have a few strategies for you to try. It might sound odd, but not everyone can remember that most winches need a winch mount. Or that certain winches require a hidden harness stored at the bottom of a book (hello, Can-Am). Or that Honda has split its winch harness between the winch and the mount. If you don't want service techs to hate you, you need to order both part numbers or else face their wrath.

Unleash Your Experts: How to Be a Long-Tail Resource for Powersports Enthusiasts

Closing deals and providing service are a dealer’s bread and butter, but your dealership has far more to offer.

Building a Growth Stategy With a Powersports Playbook

Success isn’t a fluke, and it’s not luck. It’s a strategy.

Fostering an F&I Culture That Sells

Dealership success hinges on the ability to cultivate a strong F&I culture.

Increasing Profits Through Accessorizing

Go out and find the units to dress up — there’s lots of extra profit to be made.

Other Posts

AJ Meisel Creates Community at Plano Kawasaki Suzuki

AJ has learned a thing or two over her 30-year powersports career.

Q&A: Powersports Consumer Sentiment Forecast for 2024

Consumers aren’t delaying purchases because of the economy, but they’re still looking for deals.

Nothing But Good Vibes at Santa Barbara Motorsports

Santa Barbara Motorsports is working to make every door swing count.

To E-Bike or Not to E-Bike?

When it comes to e-bikes, it’s the wild, wild West out there.