In a passion-based industry like the powersports market, emotions can color basic business decisions.

In a passion-based industry like the powersports market, emotions can color basic business decisions.

Face it, given the economic downturn of recent years, selling ATVs and UTVs has been a hard way to make an easy living. However, being objective and rational, it looks like the market is making a comeback. The OEMs and the aftermarket alike have experienced solid growth since 2010. If you break the numbers down, more than half a million UTVs were sold in that timeframe, and an equal number of ATVs has passed through the retail pipeline as well. Forget emotion, the cold hard fact that more than one million new units are now in use is something you can take to the bank.

ATV sales are up marginally. The latest Motorcycle Industry Council Flash Report indicates that ATV sales are up for Q1 2014, as 45,388 units sold from January-March. Granted, the increase is only 0.5 percent over the same timeframe in 2013, but that is worlds better than the double-digit drop experienced in the scooter market and the continuing woes of the dirt bike market.

Not reported by MIC is the real bellwether for the 4-wheel market: UTVs. The North American UTV market continued to grow significantly in 2013 as recreational applications helped increase sales by more than 9 percent to approximately 353,500 units — a new record, according to Power Products Marketing. PPM is a Minneapolis-based research firm that provides detailed market share data and research services to the global power equipment industry.* According to PPM, the strong growth surge was again led by Polaris Industries, which now enjoys a UTV market share of more than 40 percent, followed by Deere and Kawasaki.

Not reported by MIC is the real bellwether for the 4-wheel market: UTVs. The North American UTV market continued to grow significantly in 2013 as recreational applications helped increase sales by more than 9 percent to approximately 353,500 units — a new record, according to Power Products Marketing. PPM is a Minneapolis-based research firm that provides detailed market share data and research services to the global power equipment industry.* According to PPM, the strong growth surge was again led by Polaris Industries, which now enjoys a UTV market share of more than 40 percent, followed by Deere and Kawasaki.

However, BRP/Can-Am may be the one to watch. “BRP’s market share in both ATVs and side-by-side has grown since 2010,” says Jerrod Kelley, Media & PR consultant for BRP / Can-Am. “We’re currently the leader in big-bore ATVs and a strong No. 2 in side-by-sides. Along with its positive reputation, the Can-Am brand has become more prevalent due to our substantial product offerings and innovative approach. These include the introduction of the versatile Commander line of side-by-sides, the redesign of the Outlander ATVs, the launch of the Maverick 1000R family and now a strong model-year 2015 launch, with the do-it-all Outlander 6×6 ATV and value-driven Oulander L models.”

However, BRP/Can-Am may be the one to watch. “BRP’s market share in both ATVs and side-by-side has grown since 2010,” says Jerrod Kelley, Media & PR consultant for BRP / Can-Am. “We’re currently the leader in big-bore ATVs and a strong No. 2 in side-by-sides. Along with its positive reputation, the Can-Am brand has become more prevalent due to our substantial product offerings and innovative approach. These include the introduction of the versatile Commander line of side-by-sides, the redesign of the Outlander ATVs, the launch of the Maverick 1000R family and now a strong model-year 2015 launch, with the do-it-all Outlander 6×6 ATV and value-driven Oulander L models.”

In fact, as this issue was going to press, the 2015 Can-Am media kit was hitting the consumer press. The value-proposition of the two “L” model ATVs and the growing strength of the Maverick side-by-side definitely make Can-Am a contender in the heavy weight ranks. With the early release of the 2015 product line, it was too soon to get Kelley to speculate on where Can-Am goes from here, but that didn’t stop us from asking!

“I really can’t comment on future product or our strategic approach,” he says. “However, BRP is an industry leader and will continue to develop ATVs and side-by-side vehicles that appeal to the end users and their demands. Whether that’s more vehicles that appeal to a certain niche or enhanced cross-over abilities remains to be seen.”

4WheelDirt.com Goes Live: ATV/UTV Site Breaks New Ground

An all-new ATV/UTV focused site was recently introduced: 4WheelDirt.com. Brought to you by the same team that produces Motorcycle-USA.com and Cycle News, 4WheelDirt.com provides a dedicated home for the 4-Wheel off-road market. “Although MotoUSA has included ATV and UTV content for years, it was time to consolidate this coverage into a more focused, truly dedicated site,” says veteran Motorcycle-USA staffer Justin Dawes.

A diehard ATV/UTV enthusiast, Dawes was the obvious choice to become the editor leading the charge at 4WheelDirt.com. “I’m looking forward to the variety that we will be bringing to the readers of 4WheelDirt,” he adds. The site features everything from ATV/UTV reviews, travel articles, gear reviews, industry news and racing coverage.

“We live the sport! From reviews and racing, to project builds and camping expeditions, the 4WheelDirt team will strive to keep you entertained and informed,” concludes Dawes. Log on to www.4WheelDirt.com to get the straight scoop.

The aftermarket numbers confirm these trends. “Polaris has been our bread and butter for the past four years, more specifically the RZR,” says DragonFire’s social media manager Chris Moore (who shot the Can-Am on the cover of this issue, incidentally). “But moving forward, we see Can-Am becoming a real player.” That being said, Moore notes that the aftermarket accessories firm saw an unusual spike in dealer orders for Arctic Cat’s Wildcat UTV this spring. “The more the merrier we say,” says Moore.

There is huge potential for aftermarket accessories, so much so that our friends on the automotive side at SEMA clued into the fact that more than 670,000 UTVs were sold between 2010-2012. And unlike motorcycles, you can multiply your tire/wheel/shock sales x4! Clarity Research teamed with SEMA to put together the UTV Accesorization report to help its members understand the value of the UTV market. “By looking at accessory purchases, vehicle usage and interests, you can better understand the buyers that are likely to be your company’s customers,” says the SEMA report.

“Understanding the needs of these key consumers can help you better serve your customers.” This approach works equally well on the powersports dealer level. “Expansion opportunities may exist with customers you haven’t previously targeted. By recognizing the similar needs and interests of UTV consumers, you may be able to tailor existing services to prospective crossover segment,” again what SEMA says makes sense, but it is their findings on the numbers side that are most interesting:

1) About 82 percent of owners have purchased or plan to purchase upgrades to their UTV. More than 410,000 households in the United States buy UTV accessories.

2) Accessory decisions are made early. Most purchases occur within the first three months and many are completed at dealerships or direct through the OEM. Personal sources, such as dealers, friends and family, have the greatest impact on these buying decisions.

3) Sport models are the most accessorized. Sales for this type of UTV is more common in the West, and owners of these vehicles are more social, often riding with passengers and in groups.

ATV Safety Blitz

The ATV Safety Institute is launching all-out safety blitz this summer. Set for June 8-15, ATV Safety Week will be highlighted by free ATV RiderCourse training throughout the country. ASI is currently seeking dealers to partner with. ASI will support each event with information on the website and send participants ATV safety educational materials. ASI also can assist in offering the ATV RiderCourse at no cost, as well as with site selection, course scheduling, registration materials, and completion materials. Groups or others interested in joining ATV Safety Week should contact ASI at [email protected] or call (949) 727-3727 X3064.

The ATV RiderCourse gives riders the opportunity to learn how to safely get the most out of their machines on a closed-course range, with the help of a licensed ASI Instructor. The RiderCourse is free for anyone who signs up during ATV Safety Week. The RiderCourse is also free year-round for anyone who has purchased a new, qualifying ATV from an ASI member company. The ASI offers easy enrollment at atvsafety.org, or call 800-887-2887.

ASI also offers a free E-Course, available online 24/7. This online course is available in three age-specific courses for adults, teens and children. Students in each course learn how to apply the “golden rules” of ATV riding in an interactive setting. The course includes videos, pictures and interactive games to make it a fun and effective learning experience for all ages. After taking the course, users can take an ATV safety exam and receive a certificate of completion.

The All-Terrain Vehicle Safety Institute (ASI), a not-for-profit division of the Specialty Vehicle Institute of America (SVIA), was formed in 1988 to implement an expanded national program of all-terrain vehicle (ATV) safety education and awareness. The ASI is sponsored by Arctic Cat, BRP, Honda, Kawasaki, KYMCO USA, Polaris, Suzuki and Yamaha.

Multipurpose vehicles comprise the largest segment of UTVs sales with the highest volume residing in the South. Owners seek ultimate versatility with their vehicles and its modifications.

Utility model sales are strongest in the South and Midwest. Owners perceive and use their UTV as a tool, focusing on practicality and durability. They are the least likely to upgrade their vehicle and are the most solitary, frequently driving their UTV alone.

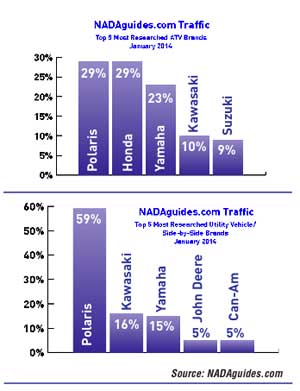

A rising tide floats all boats, as they say. The demand for new units has helped keep older units in use and kept the value up for clean late model machinery. According to NADAguides new Market Insights report, the bad weather actually helped drive up utility ATV sales. The appraisal guide/valuation experts surveyed dealers across the country to find out what used units were moving for a comprehensive report released in January. “The best selling categories in the past 60 days have been Utility ATVs at 39.2 percent followed very closely by utility side-by-sides at 24.3 percent,” notes Lenny Sims, NADA’s VP of operations. Sport side-by-sides accounted for a solid 8.1 percent of the sales during this time. “However, as the industry heads into the spring season, NADAguides anticipates a greater move toward new unit sales causing the used market to soften slightly.”

Unlike new unit sales, Honda is right with Polaris when it comes to used units, according to users of NADA’s online search tools. “Consumer behavior is a key indicator in predicting market activity,” says Sims. “We included the most researched brands and regional activity for January 2014 in the Consumer Overview section of the NADAguides Market Insights, where Polaris and Honda tied for the most researched ATV brands.”

Yamaha was a close third on the ATV side (see corresponding chart). For the side-by-side segment, Polaris had the lion’s share of search activity with a whopping 59 percent.

We are not suggesting that dealers give up their passion for motorcycles, but simple math should dictate taking a closer look at the ATV/UTV business to see what you’re leaving on the table. SEMA’s research indicates that regardless of the make, model or geographic location, the average UTV owner spends more than $1,550 on accessories… and they are relying on you, Mr. Dealer to help them with this buying decision.

*PPM’s 2013 North American Utility Vehicle Market Report and research services are available to original equipment manufacturers (OEMs), component & aftermarket suppliers, associations and government agencies linked to the global power equipment industry. Learn more at www.PowerProds.com.