This latest update on how the COVID-19 pandemic has affected the powersports market continues to tell the same story we have been covering for the past several months, namely that prices are up across the board once again. Defying historical trends, the entire powersports market has seen unprecedented growth in values for September. This time of year usually sees declining values among all the road going segments (cruisers, street bikes and scooters) as the pending arrival of colder weather for much of the country dampens sales. At the same time, ATVs and utility vehicles, though year-round units, tend to see increased demand due to farming, hunting and other fall activities. These patterns have been completely upended at the moment.

After a spring where dealers learned how to operate their businesses during a pandemic and a summer where retail sales set record after record, they are now facing a fall where inventory shortages are a major concern. The high levels of retail sales during the past several months have left showrooms seriously depleted. Manufacturers are still ramping up production from spring/summer shutdowns, and the remarketing channels are running at significantly reduced volumes from normal. This has led dealers to hold onto more units that come in as trades, and many are even prospecting for inventory in novel ways such as seeking them from the general public.

DEALERS AND INVENTORY SUPPLY

As mentioned above, the biggest concern for many dealers today is acquiring inventory. The torrid pace of sales, both new and used, has created one of those “good problems” to have situations. The realization that powersports vehicles are the perfect answer to the question of “How do I have fun during a pandemic?” has led to this lack of inventory. Right now, the manufacturers are trying to ramp up production as fast as possible while simultaneously shifting to the 2021 models, all while dealing with supply chain and worker safety issues due to COVID-19. All of these issues are in the process of being resolved as you read this, but while the ow of new units from the factories is increasing with each passing day, it is still not back to normal, let alone adequate to meet demand.

Along with the lack of production of new units, the flow of vehicles into the remarketing channels is also still running below normal levels. The restrictions imposed by governments earlier in the year and also health and safety reasons have slowed down the intake of new units into the remarketing process. Coupled with this, dealers are holding onto the trades they do take in to resell themselves, severely curtailing the auctions other main source of supply, dealer consignments. We have seen signals recently that all parties are doing their best to increase the supply of units for sale at the wholesale level. This includes auctions emphasizing their transportation infrastructure to get units moved from one area of the country to another, as well as their ability to help manage inventory by adjusting your product mix to match your local market conditions. Dealers have also begun to look for alternative sources on supply. Many have turned to their existing customers who may have an extra bike and the open retail marketplace, anywhere they can find bikes for the showroom floor. All of these measures will help, but until demand lessens, or production expands significantly, we expect inventory to be tight at the dealership level.

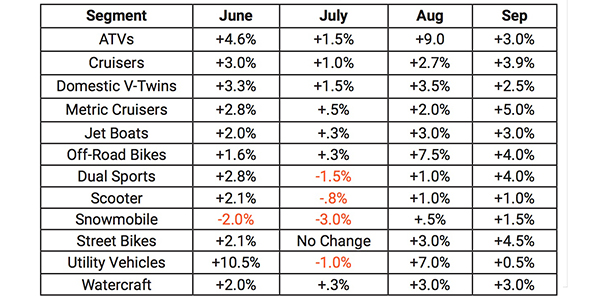

2020 Powersports Segment Changes

As you can see from the chart above, cruisers and street bikes lead the way this month. This is highly unusual for the time of year. These bikes are getting to the end of their riding season in many parts of the country. Prices usually taper off significantly this time of year. That they are this high is a sign of the unusual market conditions we are currently experiencing. The other main takeaway from these numbers is that every segment is currently increasing in value, even the snowmobiles and the personal watercraft, which almost never move in unison.

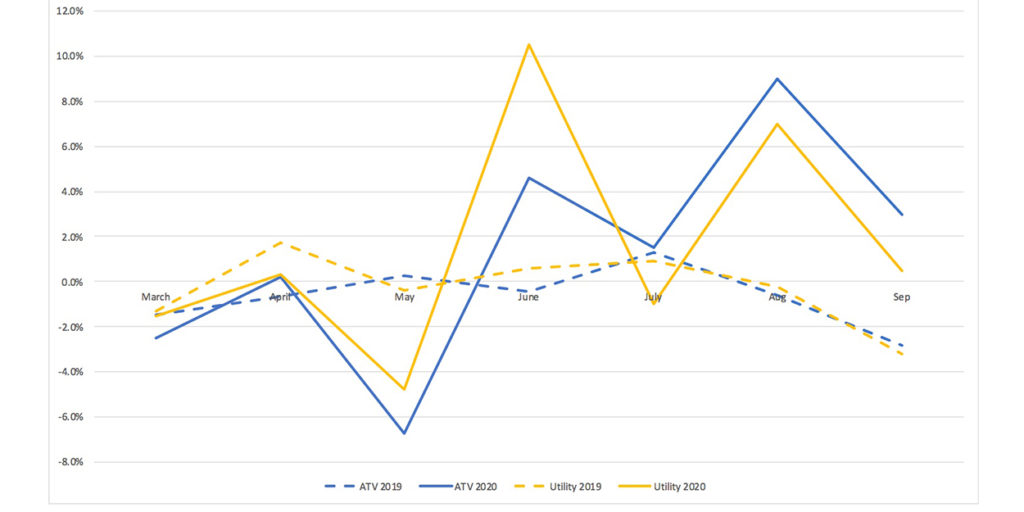

ATVs and Utility Vehicles

The ATVs and utility vehicles have increased in value once again this month, but as you can see from the chart above their rate of increase has slowed somewhat. These segments strong performance since May, coupled with their smaller value increases this month means they may be approaching equilibrium at the current point in time, but as fall is typically their strongest season, we expect them to remain in positive territory for another month or two.

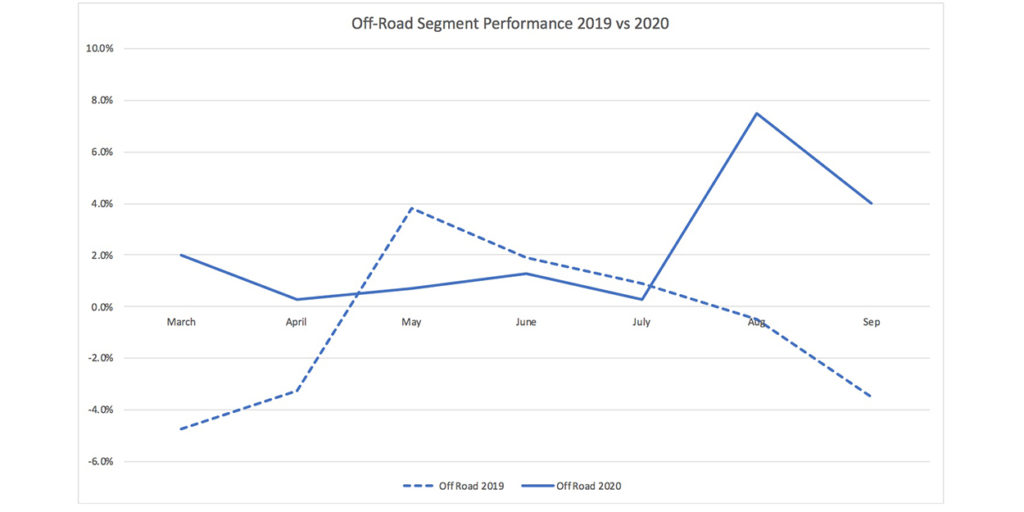

Off-Road

We may sound like a broken record at this point, but it bears repeating, the dirt bikes have been the only segment to see growth every single month this year, and they have accelerated their rate of increase over the past two months. These are some of the cheaper units in the powersports world, coupled with some of the most easily accessible for those new to the world of motorcycling, which leads us to believe they will continue to be strong performers deep into the fall.

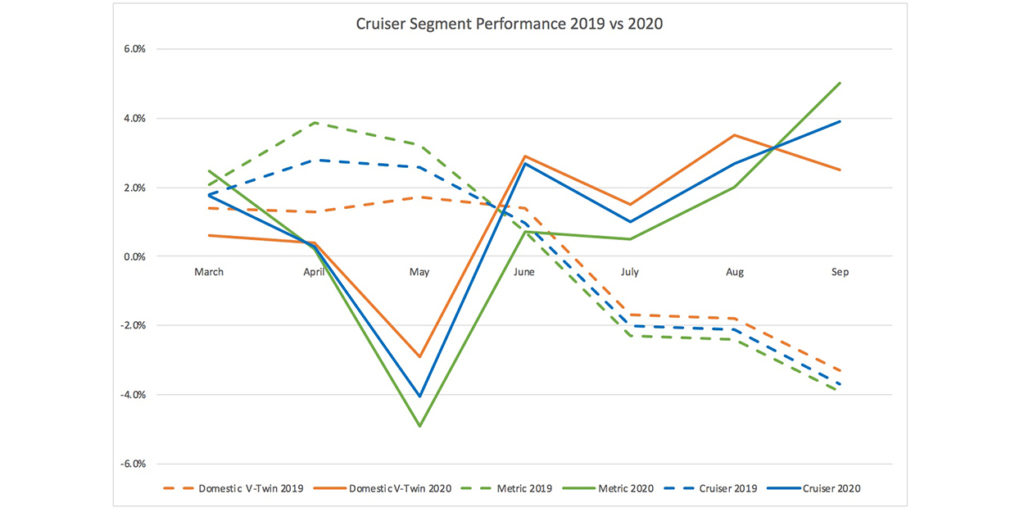

Cruisers

The widening gap for the months of July, August and September for this year versus last in the chart above nicely illustrates just how unique a situation we are in at the moment. Compared to last year (or any typical year) the late summer surge in prices for the Cruiser segment is a clear sign of the impact of COVID-19 on annual sales patterns. While off-road vehicles immediately increased their sales in the spring right as the lockdowns took effect, after a brief lag, the bigger and typically more expensive street bikes and cruisers took off and have not slowed down yet.

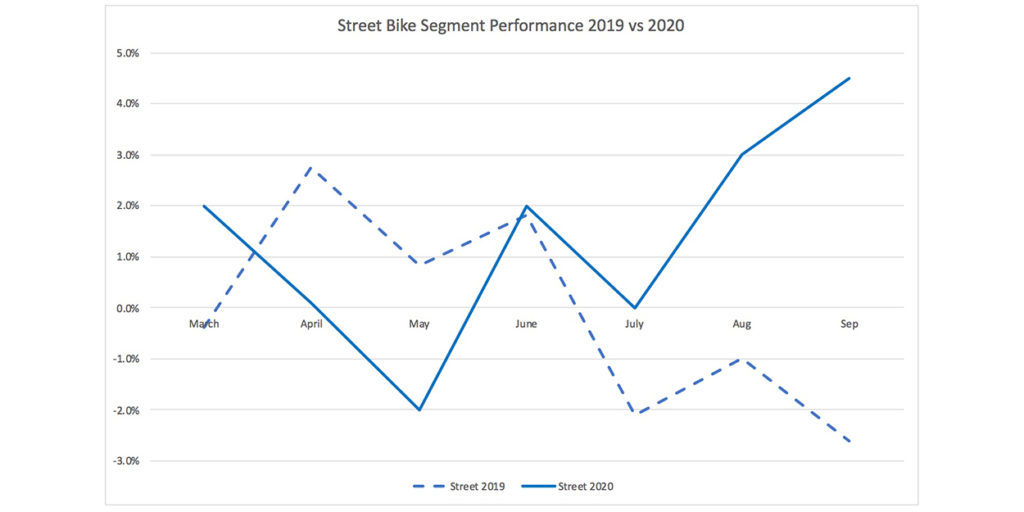

Street Bikes

Much like the cruiser segments, the street bikes are increasing in value by rather large amounts when they should be decreasing. Unlike the off-road segments, which show the 2019 and 2020 patterns similar in shape, if not actual numbers, the street bikes and cruisers are diverging completely form their prior behavior patterns. We cannot say it enough, this is unprecedented in recent history for these bikes.

Industry Insights and News

- The Motorcycle Industry Council (MIC) recently highlighted an article from the Pittsburgh-Post Gazette about how motorcycles are the perfect anti-dote to COVID-19 isolation, one of many that are now appearing in the mainstream media.

- The MIC also reported that after lobbying from the powersports industry, that proposed tariffs on Chinese helmet shipments have been delayed till at least January 2021 for now.

- SEMA cancelled their November 2020 show, while the Novi and Snowmobile USA shows for this fall have been cancelled due to COVID-19. This continues a trend of most retail and trade shows being cancelled or postponed till 2021. Bonnier also cancelled its Lucas Oil Off-Road Expo for 2020.

- Recent sales data from CDK Lightspeed shows same store major unit sales up nearly 24% from the month of July versus 2019.

- The MIC reports that new off-road motorcycle sales were up a little over 50% for the first half of 2020 versus 2019. On-road motorcycle sales dropped 9.6% and scooter sales rose 6.4% for the same period.

- BMO Capital’s Bombardier financial results include the following items: off road vehicle sales up over 60% in the second quarter, personal watercraft sales up over 20%. The watercraft numbers could have been greater but were limited due to a lack of inventory.

- Courtesy of Auto Finance News, BMO Capital Markets reports that boat sales increased 25% year over year for the most recent reporting period.

- Bombardier reported their powersports sales increased by 40% for the May-July period in North America, though revenues declined due to production suspensions in April and May. They stated that “Current trends have expanded our consumer base, creating a surge in new entrants.” They, like others in the powersports space are looking to capitalize on these new customers going forward.

The Future

We are once again facing the same questions, how long can this last, when will supply catch up with demand, and how will future health and economic changes impact powersports. To all this, add a new question, where do all the new powersports customers go in the future? We have seen repeated references from dealers, lenders, and manufacturers about the unusually large percentages of new customers. Most of these are people who have never owned a motorcycle or ATV before. Will these customers stick around and become lifelong powersports enthusiasts? Ever since the Great Recession, powersports as an industry has struggled to get back to 2008 sales levels. The coronavirus may have inadvertently given the industry the shot of new customers it has been seeking in recent years. It is also possible that recent sales surges are a temporary blip due to the coronavirus and lockdowns. Many in the industry are betting on the sheer fun factor of powersports vehicles to generate lifelong customers, and we tend to think they may be right, but only time will tell.

As to our first question about how long these good times can last? We are still of the opinion that things will slow down, but that it is increasingly looking like it may be a while before that happens. Even deep into the time when street bikes should be losing value at the auctions, they are gaining value by large amounts. Manufacturers are furiously working to stock dealers’ showrooms and at some point, the remarketing channels will start providing more normal levels of inventory. Also, has the pent-up demand for vehicles been filled, or is there a bigger well to draw from. What will happen when the coronavirus restrictions are wholesale lifted once a vaccine is available and widely distributed. Will people resume traveling at pre-pandemic levels or will they continue to use their new “toys” they have recently acquired instead?

The final big question is the economy, where does it go? In past economic downturns, powersports has generally not fared well as a significant portion of the industry is devoted to “optional” or “recreational” vehicles, some of the first expenses to go when hard financial times arrive. This has not been the case this go round as this is not a “normal” economic downturn. Our current situation was thrust upon us out of the blue due to a once in a century pandemic. As the pandemic is eventually brought under control, how does the economy shake out? Do we bounce back to pre-COVID-19 levels of activity, or does the economic damage being inflicted now start to look like a more typical recession later? All of these open questions show us that we do not yet know all the answers on where we are headed as an industry. What we do know is that the coronavirus after an initial shock, has been mostly good for the powersports industry as a whole, and that for the immediate future all signs point to continued good news for most. The longer-range outlook is a bit murkier, but we will continue to keep you updated in future updates.

Link: Black Book