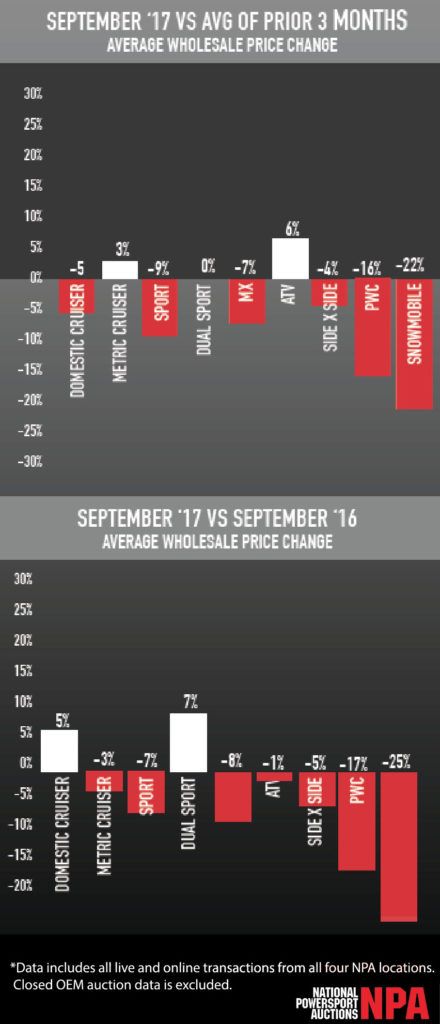

Average Wholesale Pricing (AWP) in September stabilized from the lows seen in August. Compared to the last three month average, AWP for Metric Cruisers and ATVs were up 3-6%, while Domestic Cruisers, Sport bikes, MX and Side-by-Sides slid 5-8%. On a year over year basis, Domestic Cruiser AWP actually rose while other categories were down 3-8%.

Average Wholesale Pricing (AWP) in September stabilized from the lows seen in August. Compared to the last three month average, AWP for Metric Cruisers and ATVs were up 3-6%, while Domestic Cruisers, Sport bikes, MX and Side-by-Sides slid 5-8%. On a year over year basis, Domestic Cruiser AWP actually rose while other categories were down 3-8%.

Much of the decline from last year is due to older product mix rather than softer demand. Wholesale prices rose relative to clean NADA wholesale values for almost all categories month-month, partly due to book changes at the beginning of the month and partly due to slightly stronger demand on a comparable-model basis.

Higher Metric Product Mix

An interesting trend that emerged in the September data is a seasonal shift in product mix towards a higher ratio of metric product vs. Domestic Cruisers. The same Q3 dip occurred last year with a subsequent rebound in Q4. Most of the shift is towards more metric On-Road product.

Possible explanations for this apparent product mix seasonality may be related to OEM product release cycles, differences in repossession characteristics, and differences in the inventory management strategies of domestic vs. metric dealerships. Nothing in the pricing or volume data suggests any impacts yet from the recent hurricanes.

Stocking Early

Another interesting seasonal characteristic of the wholesale powersports market is the mix of buyers that participate at various times. There is a core dealer segment that consistently uses the auction buy/sell process to optimize their inventory. Then there are dealers who prefer to preserve their capital and stock up just in time for the Spring selling season, while other dealers prefer to use their capital to stock up in the Fall before prices rise.

While there is no right or wrong strategy, the value buyers appear to be participating much earlier this year, starting in September vs. around November in years past. Only dealers anticipating a healthy, competitive 2018 retail market would have the motivation to get a head start on their peers, which we view as another sign of strength for the pre-owned market.

All data provided by National Powersport Auctions. For more information, please visit www.npauctions.com.