This month, we’ll review August 2012 P&A department performance data. Following our past format, we’ll compare a good-performing metric 20-group with the national norm numbers and the averages for the top five dealers in each category.

This month, we’ll review August 2012 P&A department performance data. Following our past format, we’ll compare a good-performing metric 20-group with the national norm numbers and the averages for the top five dealers in each category.

Although we call it P&A, we are actually talking about parts, clothing (or garments, if you prefer) and accessories. If you are not already doing so, start tracking them separately in your DMS. We have that ability in our data system, but not all of our dealers are separating this yet. Be aware that this requires you to go into your DMS and verify that the categories on the price guides are correct. In general, most of the OEs have errors that must be corrected. It takes time, but it will be worth it. If your DMS has this feature, be sure to check the box that prevents the next update from overwriting your new category changes.

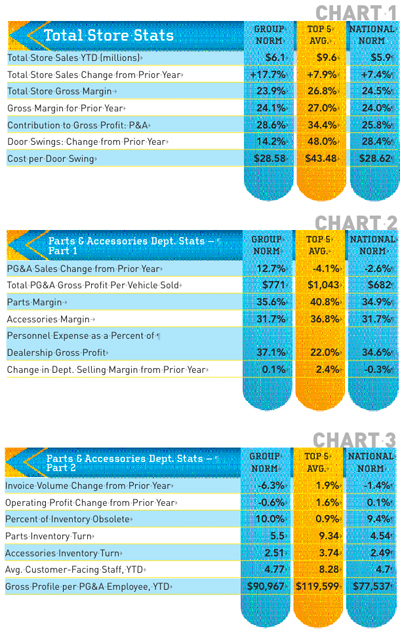

Total store stats reveal that through the end of August, the top five dealers averaged $9.6 million in total sales. This selected group and the national norm dealers averaged around $6 million.

In the past, I have used total store sales percent of change from the prior year because that is the way our reporting system calculates this item. This has caused some confusion, since percent of change is not the same as percent of increase or decrease. For example, this month shows a 7.9 percent increase in sales for the top five dealers compared with last year. That actually represents a percent of change of 26.9 percent. Therefore, from this point on, we will use a simple percent increase or decrease number.

Total store gross margins are showing the effects of increased expenses and competition. While the decrease is small, it is still a decrease in profitability. If you are a $6 million dealer, 1 percent equals $60,000 of profit. Contribution to gross profit shows just how significant the performance of your P&A department is to your overall dealership profitability.

The door swings measurement shows that dealers are bringing in more floor traffic — people are shopping. If you don’t have one of these inexpensive counters, get one. The sooner you do, the sooner you can develop baselines for comparison with all departments. Door swing counters also help you measure things like the response to your ads and promotions as well as tracking the general shopping/buying atmosphere. You can get counters that will tie directly into your DMS. Some security systems may offer this feature as well.

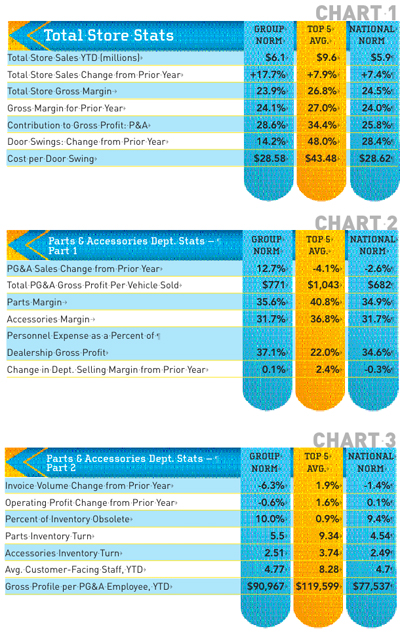

The sales change numbers are interesting. The group is bucking the general trend and showing a sizable increase, while the top five and national norm dealers are down from last year. The consensus seems to be that P&A sales had been inflated by the numbers of people fixing their units instead of trading or selling them. As unit sales have increased, P&A business has decreased. I suspect this is a part of it. Another factor is the lack of financing for P&A in the unit sale. The lenders are still playing hard-to-get and not providing room for add-ons.

Wise dealers are running P&A promotions (mostly by email and direct mail) focused on traffic-building for this department. It is also a good time to ensure your counter staff has sales training and is working hard to capture the additional sales you need.

Looking at margins shows that the top five dealers are doing an excellent job. These dealers pick up additional margin by maximizing the OE discount programs. They also work their non-OE vendors to secure better discounts. Aftermarket vendors often have a lot of flexibility. Hint: You will have more buying power if you reduce the number of vendors you use. You may not always get the best price on a particular item, but you can get a much better margin on the overall if you do it right.

Be sure you check your personnel expense as a percent of department gross profit to see if it is in line — less than 35 percent is the target.

As expected, invoice volume dropped as sales decreased. However, operating profit has remained relatively stable.

Although obsolescence is included, it is really not a “real” number in the sense that much of this inventory has been written off the books for tax purposes, but may still exist in the dealership. If it has not sold for a year, get rid of it. Follow the “Three Ds” — discount, donate or dumpster it. If you sell it, be sure to put it back into your system or the IRS will pay you a visit. The ultimate goal is to run the slow-movers’ and non-movers’ reports monthly so you can eliminate inventory before it becomes obsolete. Try to catch these numbers early enough to use your suppliers’ return programs. In most cases, it will not increase in value as time goes on.

Continue to monitor your number of turns regularly. Remember that you can get to the point where you don’t have sufficient inventory. If you have to special order too many parts, you will lose your customers.

Finally, the dollars sold per employee is a very important measurement of the effectiveness of your staff and your staffing levels. Check it out and see where you fall in this category.

Have questions? Feel free to contact me for information, explanation or to discuss how GSA can help you grow your business profitably.