At the beginning of the year, we predicted that motorcycles would be mostly flat to down and that SxS/UTVs and ATVs would be growing. But by how much was difficult to predict.

Despite the industry being plagued with challenges, such as tariffs and rising interest rates, among other macroeconomic concerns, dealers have remained positive in the first quarter, according to our sources.

In November of last year, Mike Webster, former senior vice president of AIMExpo/MIC Events, commented that the growth of ATVs and UTVs have been phenomenal.

“In just the last five years alone the SxS and ATV segment has grown by more than 100,000 new units, and we surpassed the 500,000 mark in 2017,” Webster said. “The sheer versatility of these products makes them a viable option for a significant portion of the population, so it’s not surprising to see that this is one of the strongest segments in the marketplace.”

But there are signs that the market may plateau in the latter half of the year due to the sheer product mix and volume of units now in the market place. NPA’s Jim Woodruff suggests that the numbers, while showing slightly down on the pre-owned side, could be misinterpreted because the units are continuing to hold value. “We see SxS units come through the auction lanes that are holding values comparable to premium motorcycles.”

Woodruff believes that one of the reasons SxSs hold value longer than other segments is because there is still strong demand from consumers and not enough inventory to satisfy the need.

When the Yamaha Rhino was introduced in 2004, consumers flocked to it and manufacturers took notice. It was the first UTV classified as a recreational as well as a utility vehicle, and off-road enthusiasts ate it up and wanted more.

The term “golf cart on steroids,” was used to describe these early ROVs, which manufacturers didn’t care for, so they started looking at building a better performing side-by-side vehicle, which was the Yamaha Rhino.

With the current iteration of sport side-by-sides boosting the horsepower through the use of turbos, the need for stronger parts and performance work has increased. OEMs are adopting the performance and technology used on other products to enhance the SxS into a different machine that attracts riders from many segments. Companies catering to the market are reaping the rewards on the aftermarket side, supplying everything from tires and turbos to stereo equipment, because today’s SxS customer is willing to spend money on the vehicle for their family and friends to enjoy.

Many customers are seeking dealers to customize their ride beyond stock. Custom creations go from mild to wild, and dealers can find many options to cater to this market from adding aftermarket seats and belts to custom paint and bigger wheels and tires. Keeping the purchase and installation in-house certainly adds to the bottom line, according to one dealer.

UTV specific tires are starting to take off, with more new tires than ever before. Riders can either choose tires that are extremely specific to the type of terrain that they ride or they can choose from a multitude of all-terrain/intermediate tires that are more like light truck tires.

Jason Baldwin, director of powersports for Kenda Rubber, said that the most significant trend for UTV tires is a light truck tire.

“The biggest things our customers want is something that can handle mud/rocks/street/gravel all in one tire,” Baldwin said. “On the ATV side, customers don’t typically want to spend much, so it is the ‘cheapest tire you’ve got.’“

With UTVs now the largest segment of the powersports industry, and combined with ATVs, there are roughly 620,000 units sold per year, according to sources. ATVs sales, according to the Motorcycle Industry Council is 220,000 per year out of that number, while motorcycle sales lag a little behind at 420,000 units per year (340K street, 80K off-road). However, total registrations for motorcycles are significant at 8.4M in 2014.

Some of the challenges for this segment in the next six to eight months are that there aren’t many new riders being added. However, we might also argue a few current street riders are moving to UTVs. Aftermarket manufacturers for the segment note other challenges as well.

Baldwin said that they are facing multiple Chinese manufacturers “dumping” tires into the U.S. for minimal cost, driving down margins for tire manufacturers and dealers. He also notes that some Chinese manufacturers are selling directly to consumers on third-party sites and bypassing distributors/dealers altogether.

Baldwin thinks the segment could plateau some, but still have some growth. “We need to see machines that are under $10k out the door to a dealer for a UTV to attract new customers.”

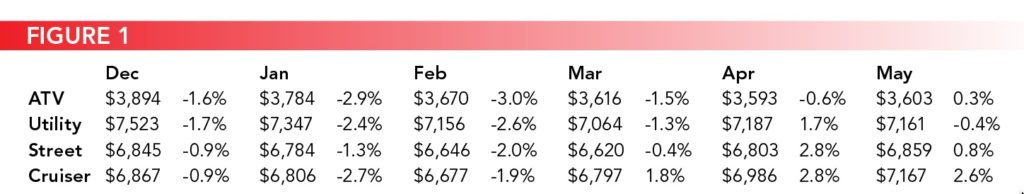

Scott Yarbrough, senior analyst of motorcycle and powersports for the Black Book put together a chart showing the ATV, UTV, street bike and cruiser segments value performance over the past six months, see FIGURE 1.

The ATV and UTV segments have each performed about the same during that time frame, according to Yarbrough.

“Each has been down somewhat, but a large portion of that is the normal seasonality in the market, as December through February is typically the low point for powersports values,” Yarbrough said. “The street and cruiser segments have risen a bit more and at a faster pace, but this is their prime time of year whereas the ATVs and UTVs typically peak towards the fall. This chart would look rather different if it were for June through November, as the trend would most likely show the street bikes and cruisers on the decline, and the ATVs and UTVs are increasing.”

The utility vehicles recent lackluster performance has been a little bit surprising. This is still an extremely desirable segment which has retention values higher than the norm for most powersports vehicles. For example, if you take the average retention value (the percent of MSRP the vehicle still commands at auction) of each of these four segments, the results look like this:

2010-2018

ATV 51.7%

Utility 56.4%

Street 55.2%

Cruiser 52.7%

While Yarbrough notes that the chart above is a rough comparison, as it includes all vehicles for the years 2010-2018 averaged together, without taking changes in product mix and sales volume into account, it does indicate strong retention values.

For comparison here is the same set of numbers for 2017:

2017

ATV 63.5%

Utility 64.9%

Street 66.5%

Cruiser 71.4%

The UTVs, in particular, have been very popular for the past decade or so, but the number of units manufactured has increased quite dramatically over that time.

“Traditionally, off-road vehicles have had lower value retention compared to street bikes, but as you can see from the first set of numbers, the UTVs are outperforming the street bikes and cruisers, but this does not hold true for two-year-old vehicles,” Yarborough said. “This is very much a function of the fact that five, six or seven years ago there were not enough UTVs to meet the demand, which drove prices up, and continues to be reflected in the pricing for the older units. As supply has caught up with demand, these vehicles have begun to revert to their historical norms. Also, as mentioned above, the current seasonal trends are depressing the relative performance of the UTVs versus the road going bikes.”

Overall, the outlook for the UTVs, in particular, is bright for the rest of 2019, though their value gains are more likely to be of the slow and steady kind, rather than any rapid changes.

As one manufacturer of ATVs and SxSs told us about the health of the market a few years ago, continues to ring true today:

“The side-by-side market is evolving, and that’s a good thing for dealers and consumers who will have more selling and buying options… The two-wheel guys have taken an interest, the car guys have taken notice and any SxS enthusiast who cares anything about sport-performance is craving seat time.”