Last month we looked at the 2009 year-end national norm numbers. This month, we’ll explore the year-end numbers for the TBOC.

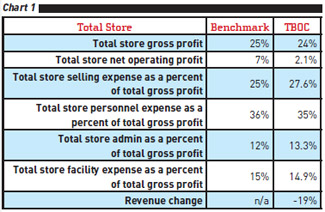

In chart 1 you can see that these dealers were getting close to 25% gross profit and actually showed over 2% net for the year. This is primarily due to the huge effort they have made to get expenses in line with benchmarks.

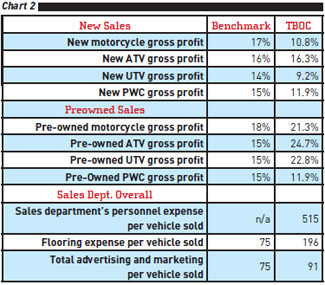

Chart 2 shows the effects of reducing new motorcycle inventory. Flooring expense was still high. Advertising was coming down as dealers focused on shows and events. ATVs and pre-owned sales were areas of profitability. I’ve been extolling the virtues of pre-owned in this column for some time, and these numbers show why it is important to grow this area of your business.

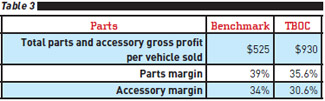

Chart 3 reveals P&A gross profit per vehicle sold is very strong. This is due to reduced unit sales and the focus on maximizing P&A sales. I hope this effort won’t be lost when the market returns. Surveys prove that customers who purchase more P&A at the time of the vehicle sale return higher CSI scores.

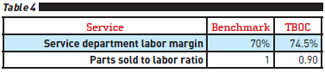

The service end of the business remains strong. Dealers are learning to concentrate on maximizing technician work time and eliminating non-producers. As a result, the gross profit is up.

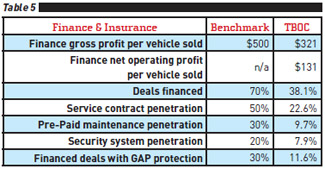

F&I is weak due to poor finance approvals and credit limitations. Yet, this is an importance profit center; be sure you have the strongest performer you can find in this position — look for them now.

As you can see, it is not all "gloom and doom" out there. Dealers are making money by controlling expenses and hiring top quality employees. As I have said before, there is no reason to have "B" and "C" players when there are "A" performers looking for jobs.

Track your numbers, keep your inventory under control, hire the right people and provide exceptional customer service. These are still the keys to success.

Elevating Your Sales Game Through Parts Packaging

Breaking down the art and science of a well-designed, customer-focused, profit-friendly parts package.

Good parts managers are a rare breed. We are among the few who enjoy flipping through paper catalogs and covering them with notes. We love seeing how other companies merchandise shelves. We are always absorbing different sales techniques and wondering if we could use them too.

In that vein, when it comes to continuing to boost our numbers post-COVID, I have a few strategies for you to try. It might sound odd, but not everyone can remember that most winches need a winch mount. Or that certain winches require a hidden harness stored at the bottom of a book (hello, Can-Am). Or that Honda has split its winch harness between the winch and the mount. If you don't want service techs to hate you, you need to order both part numbers or else face their wrath.

Unleash Your Experts: How to Be a Long-Tail Resource for Powersports Enthusiasts

Closing deals and providing service are a dealer’s bread and butter, but your dealership has far more to offer.

Building a Growth Stategy With a Powersports Playbook

Success isn’t a fluke, and it’s not luck. It’s a strategy.

Fostering an F&I Culture That Sells

Dealership success hinges on the ability to cultivate a strong F&I culture.

Increasing Profits Through Accessorizing

Go out and find the units to dress up — there’s lots of extra profit to be made.

Other Posts

AJ Meisel Creates Community at Plano Kawasaki Suzuki

AJ has learned a thing or two over her 30-year powersports career.

Q&A: Powersports Consumer Sentiment Forecast for 2024

Consumers aren’t delaying purchases because of the economy, but they’re still looking for deals.

Nothing But Good Vibes at Santa Barbara Motorsports

Santa Barbara Motorsports is working to make every door swing count.

To E-Bike or Not to E-Bike?

When it comes to e-bikes, it’s the wild, wild West out there.