Trade Dispute Could Gut U.S. Off-Road Industry

“What’s the game plan? Well… there is none if that tariff comes into play,” admits Gravity TM Racing USA’s Ralf Schmidt. As the exclusive U.S. importer of hand assembled competition off-road motorcycles, TM is set to be the real loser in a trade war that has nothing to do with the motorcycle market. Actually AMA notes more than a dozen European brands are in the crosshairs, including BMW, Ducati and KTM. The grim reality is that an onerous tariff on motorcycles would most impact the boutique bike businesses who can afford it the least.

Back in December the Office of United States Trade Representative requested comments regarding its proposal to include tariffs of 100% or more on 50cc-500cc motorcycles imported from the European Union as part of the U.S. beef hormone trade dispute. The deadline to submit comments was January 30, but the jury is still out for now. “It’s clear that European motorcycles have nothing to do with U.S. beef products – so to include them in a trade war appears to be a reckless decision,” says Moto AJP’s Scott Armstrong. “The damage done to the motorcycle industry and a lack consumer choices will be huge if the tariff does go into effect… it will result in the closing of many U.S. businesses with 1,000’s of jobs lost in the process.”

At a time when the off-highway sales are the only segment of the motorcycle market showing growth, the beef tariff could cripple the entire U.S. motorcycle market. According to the Motorcycle Industry Council’s 2016 tally, Off-Highway motorcycle sales accounted for 89,446 units – up 7.7% where the rest of the motorcycle market finished the year at -3.3%

“Should the availability of motorcycles be hindered by these unjustified trade sanctions, dealerships may close, leaving countless Americans without jobs,” claims AMA VP of government relations, Wayne Allard.

The AMA opposes the proposed tariff on the grounds that trade disputes within the agricultural sector should not be solved with trade sanctions levied against non-agricultural products like motorcycles. “It’s not just the bikes – it’s also the bike dealers, and sales of apparel, and sales of parts,” adds AMA spokesman Pete terHorst. “If the agency enacts this motorcycle tariff, serious and potentially irreversible harm will be done to American small- and medium-sized business owners selling the vehicles and to American families who buy these motorcycles for commuting and outdoor recreation.”

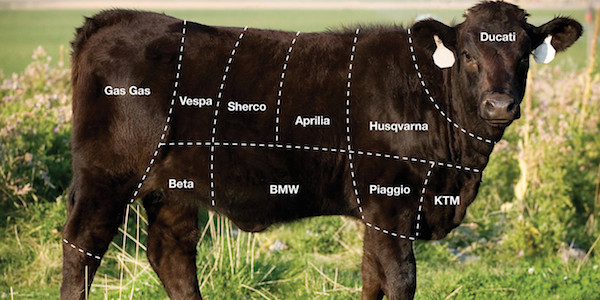

To get technical, the tariff is not just “beef” – additional BS specifically identifies “guts, bladders and stomachs of animals (other than fish), whole and pieces thereof, fresh, chilled, frozen, salted, in brine, dried or smoked. Foliage, branches and other parts of plants without flowers or flower buds, and grasses, suitable for bouquets or ornamental purposes.” Specifically, a 100%, or higher, tariff on all motorcycles from 50cc up to 500cc manufactured in the EU is being proposed. AMA goes so far to point out the targets by brand name: 1) Aprilla 2) Beta 3) BMW 4) Ducati 5) Fantic 6) Gas Gas 7) Husqvarna 8) KTM 9) Montesa 10) Piaggio 11) Scorpa 12) Sherco 13) TM and 14) Vespa. While you may not automatically associate BMW with small dirtbikes, the Munich-based manufacturer has invested heavily into the launch of new G 310 GS for 2017… ditto for Ducati with the 400cc variants of their top selling Scramblers. Piaggio/Vespa and the other European scooter manufacturers already saw U.S. sales shrink by 12% in 2016 so they really can’t afford a 100% surcharge!

KTM/Husqvarna North America launched a united social media public awareness campaign, noting “lower-displacement European motorcycles were considered for retaliatory tariffs in similar proposals in the past, but each time motorcycles were not included on the final lists of products that were subject to increased tariffs. This is because industry and consumers responded by expressing their strong opposition to the action. We need your help to make sure that motorcycles are once again excluded.” By odd coincidence, at the same time the deadline for public comment expired, Husky issued an announcement showing just how much they stand to lose.

“Husqvarna Motorcycles have come close to doubling both their production and turnover in the last two years,” says the announcement from the Austrian HQ. Total global sales reached 30,700 units in 2016, a 43% increase. “This result follows the 32% gain in bike sales during 2015 and underlines the brand’s positive strategy of growth.” It also marked the third straight year of sales increases, largely attributable to the U.S. market. What’s it worth to Husky? More than 200 million Euros in global sales for 2016.

“While clearly, motorcycles should not be caught up in this dispute – it has happened before,” noted Americans for Responsible Recreational Access (ARRA) in a call to action. “In 1999 and 2008, lower-displacement European motorcycles were included in similar proposals, but each time motorcycles were not included on the final lists of products that were subject to increased tariffs. This is because industry and consumers responded!”

Mel Harris, VP of operations for SSR and former exec with Suzuki remembers a time when the trade tariff did kick in! “I remember in the ’80s when the ITC hit the Japanese manufacturers with a 49% tariff on units over 700cc. No new street bikes were available for about three years.” Suzuki and the other Big 4 weathered that storm, but it radically changed the powersports industry in the process as dealers diversified into ATVs personal watercraft and yes, dirt bikes. What happens this time if the tariff does happen? “I would think the European OEMs would delay shipping here until the tariffs were lifted,” says Harris. “It will surely impact KTM and Husky the most, but all of the smaller European-based OEMs would probably stop importing for a while.”

On a pragmatic note, he points to the previous paradigm shift, noting SSR and others will not be caught up in the political beef. “If the beef tariff goes through, we will work hard to establish the dealers needing product to survive with the SSR product line. We have contacted many of these dealers already to plant the seed we are here. We are building a strong Dealer Network with nearly 100 Big 4 type dealers already signed and more stating they are committed.”

A slow down of the imports would stifle R&D and impact the entire off-road industry. “KTM and Husqvarna have really stepped up the amount of features they are beginning to incorporate into OHV bikes,” notes Baja Designs Operations Manager Trent Kirby (see the story on off-road lighting also in this issue). “Features such as launch control, air forks, adjustable foot pegs, adjustable handlebar positions, etc., provide enthusiasts with an improved riding experience. Reliability throughout the entire off-road industry has also increased dramatically. In the niche dual sport market KTM and Husqvarna are leaps and bounds ahead of Honda, Yamaha, Suzuki and Kawasaki. While I personally feel KTM and Husqvarna improve upon existing platforms too quickly and I cannot justify purchasing a $11,000 dirt bike knowing they are going to completely revamp the bike next year, without companies like KTM and Husky pushing the envelope, we would go back to the old cycle where bike upgrades seemed to come once every five years.”

A slow down in the development cycle or a complete crippling of the entire motorcycle market? The public outcry generated by AMA, MIC, ARRA and the impacted OEMs should stave of the tariff, but if not? “Most people in the industry doubt it, but it may just be happening… who knows what they will officially announce in March?” says Gravity Racing’s Schmidt. “For TM there are not many options – maybe we will sell a lot 530cc Supermoto bikes? I honestly don’t know what the future will bring us.”

The law of unintended consequences came into play back in the 1980s ITC ban. The tariff-buster 600cc sportbikes brought in by the Japanese proved a boon for AMA Roadracing and sales for dealers. It spurred small displacement dirtbike development, propelled the PWC market to prominence and also gave Harley a monopoly on the heavyweight market, which they continue to enjoy to this day. What could happen if the beef ban does stick… maybe a reverse tariff-busting 500cc class from KTM/Husky/Beta/GasGas? The rise of EV motorcycles since they technically don’t have a “CC” displacement or even the return of the legendary 501 Maico? Boggles the mind!

CHOPPED LIVER?

AJP Under The Radar

Out of sight, out of mind can be a good thing. Based in Portugal, the brand has been around since 1987, but it has only been in the U.S. since 2014, so AMA can be excused for missing them in the list of brands to be impacted by the proposed Beef Tariff. U.S. importer and Moto AJP founder Scott Armstrong is out to prove a point with an affordable, air-cooled motorcycle. The motorcycle racer-turned dealer principal, and former importer/distributor of European motorcycle apparel & accessories has been at this for more than a decade. His goal is to cater to the tastes and desires of the demanding U.S. consumer, beat the BS Beef ban and prove AJP is more than chopped liver!

“Yes, we are aware of the proposed 100% tariff on European motorcycles from 50 to 500cc. Our position is that we oppose this tariff for primarily two reasons:

First, it’s clear that European motorcycles have nothing to do with U.S. beef products – so to include them in a trade war appears to be a reckless decision.

Secondly, the damage done to the motorcycle industry and consumer choices will be huge if the tariff does go into effect. It will result in the closing of many U.S. businesses with thousands of jobs lost in the process. It seems to us that the Trump administration is focused on job creation and growth – which is counter to what this tariff could result in.”

The danger of going down this path is what can happen next? “When Japan is not willing to accept some other agricultural product from the U.S. will we then impose a 100% tariff on all Japanese motorcycles under 500cc,” Armstrong questions. “Think of the result coming from that decision!”

Like the rest of the industry, AJP is stuck in wait and see mode, but Armstrong is optimistic. “Hopefully after all the constituents voice their concern, common sense will prevail and this proposed tariff will be voted down and the motorcycle option will be permanently deleted from this product list that seems to come up every so many years. Even if the proposed tariff does indeed take effect – here at AJP we are working on some contingency plans to ensure we can still offer our full line of motorcycles in the USA with minimal price increases for the US consumer going forward.”

On a more positive note, AJP Motorcycles USA is thriving. “We have grown from our original three models in 2016 to five different models in our 2017 off-road enduro bike lineup. In addition our brand is growing fast here in the U.S. and also around the world.”

The AJP Factory in Portugal recently released a brand new 600cc Adventure bike known as the PR7 in Europe (shown above). “Demand for this model is high and we hope to offer a 50-state street legal version of the PR7 here in the USA by Q4 of 2017. Our results for the USA in 2016 are now in and we added 17 new dealers in the past year, bringing our current total to 26 authorized AJP dealers around the country! Our sales are on a fast track, too – up 62% over 2015. Our projections for 2017 sales have us adding another 40% in new unit sales and signing an additional 10 to 15 new dealers as well.

While they may not make the tariff hit list or be a household name just yet AJP is more than chopped liver. “For sure we are getting to be known as the motorcycle brand that offers incredible value by providing a full lineup of very easy to ride, innovative, full suspension travel enduro motorcycles with the lowest seat heights in the industry,” claims Armstrong. “Everything is looking up and up for AJP Motorcycles here in the USA!”