I don’t know how many times I’ve heard dealers say that they don’t cater to the subprime audience – or better yet – they don’t have subprime customers.

It is true that closing a transaction with a prime credit profile customer is usually faster and relatively easier since they are more likely to qualify for higher credit limits. In these instances, lenders typically ask for fewer stipulations, which in return may require less of your staff’s time and energy to complete the sale. But why would you turn your back on additional customers with less than perfect credit?

If, for example, you could sell 50 units this month to prime credit customers, but also add incremental (subprime) sales to your existing business to boost the bottom line, wouldn’t you take that deal?

20% Increase in Sales, 100% Increase in Profits

Your dealership has standard fixed costs such as rent/mortgage, payroll (excluding the sales related commissions), utilities, etc. If your gross margin point requires you to sell 40 units, it means that you will make money when you sell over the threshold of 40 units because 40 units are required to cover your expenses. Now let’s assume that you add 10 new subprime customers per month. That represents 20% increase in your sales but approximately 100% increase in your profits. Before the subprime customers, you were benefiting from 10 unit sales over your gross margin point and now you have 20 units over your gross margin point. Better still, this 20% increase in sales might mean more than 100% increase in profits since the subprime buyers often generate higher gross profit than prime buyers.

Some of you might think that your geographic location has more of the prime credit consumers and it is a challenge to find the sub-prime credit ones. This assumption is not accurate. Experian estimates that only 58% of Americans have excellent or good credit, while 30% have poor credit and another 12% have near prime credit. If you don’t have subprime shoppers, it is not because they don’t exist in your community, it is because you don’t have offerings tailored for that demographic.

Used versus New Vehicles

Used versus New Vehicles

Since the subprime customers most often buy used vehicles, try to increase your used unit inventory. Subprime lenders typically require a fee from the dealer for the extra risk of loaning to a higher risk customer so you should be careful to have enough margins in your pricing. There’s an old saying that says you make your money when you buy the units right! But you should also focus on doing a good job of buying the used vehicles that subprime customers predominantly buy.

If you are a franchise dealer, keep in mind that a good mix of used vehicle inventory will help you sell more of your new units. You may bring in shoppers interested in a used vehicle only to realize that for a few more dollars per month, they can get a brand-new unit.

Treat Everyone the Same

Only a fraction of the dealers emphasize selling to buyers with less than prime credit. If they don’t totally ignore the subprime customers, they want them to come through the back door.

You should use this to your advantage. Less competition means more business. If you treat these customers with respect – as everybody should be treated – you will stand out in the crowd and they will respond to it.

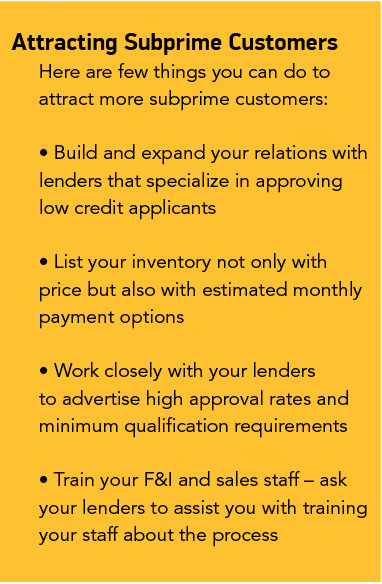

Some will take more time to complete, but a typical subprime customer generates 25% higher gross profit per vehicle. Well-trained staff and establishing relationships with subprime lenders can make the difference that you have been looking for.

Emre Ucer is the managing partner of MotoLease LLC. He oversees the development of solutions for the motorcycle and powersports industry to fit even the most credit-challenged riders.