Harley-Davidson, Inc. has released its first quarter 2018 results and confirmed its 2018 outlook. The company also announced it is accelerating its strategy for growth, anchored by its objective to build the next generation of riders globally.

First quarter 2018 net income was $174.8 million on consolidated revenue of $1.54 billion versus net income of $186.4 million on consolidated revenue of $1.50 billion in the first quarter of 2017.

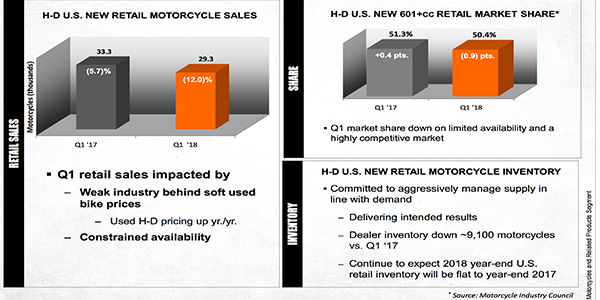

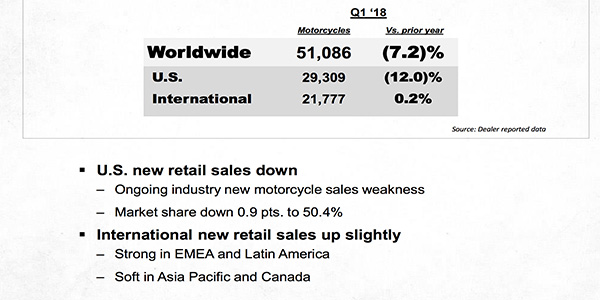

Harley-Davidson international retail motorcycle sales were up 0.2 percent in the first quarter of 2018 compared to 2017 and U.S. retail sales were down 12.0 percent. Worldwide retail sales decreased 7.2 percent.

“We are pleased to deliver revenue growth on the heels of our recent product investments in Softail and Touring. This, plus solid financial services segment performance and strong cash returns during the first quarter underscore our commitment to drive shareholder value,” said Matt Levatich, president and chief executive officer, Harley-Davidson, Inc. “Our international markets returned to retail sales growth supporting our long-term objective to increase international sales to build the next generation of riders globally.”

Considering prolonged softness in the U.S. industry and given what the company believes is untapped potential in international markets and in certain high-growth spaces globally, the company is crafting strategy accelerants to deliver significant value through 2022. Harley-Davidson plans to leverage its core business more fully and expand in new directions to accelerate value creation as it pursues its long-term objectives.

“Our view of the highly competitive global motorcycle market is grounded in a realistic assessment of risks, opportunities and capabilities needed to inspire ridership and grow our business. Our data-driven insights compel us to enhance and accelerate our strategies to ensure we deliver on our long-term objectives as we build the next generation of Harley-Davidson riders,” said Levatich.

The company is currently refining its plans and this summer intends to reveal significant additional steps to improve performance and value creation through 2022.

In the first quarter of 2018 the company commenced its previously announced multi-year manufacturing optimization initiative anchored by the consolidation of its motorcycle assembly plant in Kansas City, Mo. into its plant in York, Pa. The company continues to expect to incur restructuring and other consolidation costs of $170 million to $200 million and capital investment of approximately $75 million through 2019 and expects ongoing annual cash savings of $65 million to $75 million after 2020. In the first quarter, costs related to the manufacturing optimization were $47.6 million.

The U.S. 601+cc industry was down 11.1 percent in the first quarter compared to 2017. Harley- Davidson’s first quarter market share was 50.4 percent in the U.S. The 601+cc industry in Europe was down 7.3 percent in the first quarter compared to 2017. Harley-Davidson’s first quarter market share was up 1.3 percentage points to 10.4 percent in Europe.

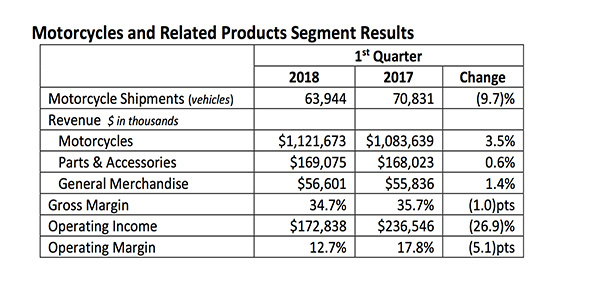

First quarter revenue from motorcycles and related products was up versus the prior year. Operating margin as a percent of revenue decreased in the quarter compared to 2017 primarily due to costs associated with our manufacturing optimization initiative.

Financial services operating income increased 20.8 percent in the first quarter compared to 2017.

The company continues to expect the following for the full-year 2018:

- Motorcycle shipments to be approximately 231,000 to 236,000 motorcycles. In the second quarter, the company expects to ship approximately 67,500 to 72,500 motorcycles.

- Operating margin as a percent of revenue to be approximately 9.5 to 10.5 percent including manufacturing optimization costs of $120 million to $140 million.

- Capital expenditures of $250 million to $270 million including approximately $50 million to support manufacturing optimization.

- Effective tax rate of approximately 23.5 to 25.0 percent.

- The company now expects Harley-Davidson Financial Services operating income to be flat to down modestly.

Link: